Bond return calculator

Investing is a long game measured in years. For the first 5 series the.

Zero Coupon Bond Value Formula With Calculator

Coupon rate compounding frequency that can be.

. The page will look just like it did when you saved your list. The rate of return anticipated on a bond if it is held until the maturity date. This handy geometric average return GAR calculator can be used with investments that undergo compounding over a number of timespans to calculate the average rate per period.

To find what your paper bond is worth today. Investing is the act of using money to make more money. When it comes to investment opportunities most people immediately think of the stock market.

This calculator enables you to compare the reaction of two bonds to changes in the prevailing rate of return in the bond market. Just connect to the Internet locate the bond list you saved on your computer and open the file. If a bond is trading in excess of its face value the current yield is lower than the coupon rate.

On this page is a bond yield to maturity calculator to automatically calculate the internal rate of return IRR earned on a certain bond. In the case of. The current market price of the bond is how much the bond is worth in the current market place.

Till now almost 59 series of SGB has been launched. You just bought the bond so we can assume that its current market value is 965. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return.

Bond price is calculated as the present value of the cash flow generated by the bond namely the coupon payment throughout the life of the bond and the principal payment or the balloon payment at the end of the bonds lifeYou can see how it changes over time in the bond price chart in our calculator. If you are interested in a particular bond use this calculator to compute the expected return based on your target price or yield. This municipal bond calculator calculates the yield from the municipal bond each year including the yield to maturity.

After solving the equation the original price or value would be 7473. YTM is considered a long-term bond yield expressed as an annual rate. And in most cases they can expect to get their initial investment back on or before the date the bond matures.

You would need to discount the price of your bond to the point where the buyer would achieve the same total return being offered by the bond paying 8. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button. Sovereign Gold Bond SGB first series was launched in Nov 2015.

Figure the Market Value of Bonds. Example of Zero Coupon Bond Formula with Rate Changes. Version 9 - 11.

Of Annuity Bond Yield Mortgage. Related Interest Calculator Average Return Calculator ROI Calculator. Yield to maturity YTM.

This calculator automatically assumes an investor holds to maturity reinvests coupons and all payments and coupons will be paid on time. To arrive at this figure the stock calculator divides the total return on investment by the total original investment and then multiplies that result by 1N where N is the number of years the investment is held. Once open choose the series and denomination of your paper bond from the series and denomination drop-down boxes.

Sovereign Gold Bond SGB is the best way to invest in gold in India as you get price appreciation as well as fix interest of 25 PA from Aug 2016 series. The ASX bond calculator is used to calculate bond prices and yields for Exchange-traded Australian Government Bonds AGBs and other standard fixed interest bonds. Return Rate CAGR Annuity Pres.

See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula. Click on the Return to Savings Bond Calculator button at the top of the page and your list will automatically update the values to the current date at that time. A 6 year bond was originally issued one year ago with a.

In addition the tax equivalent yield of the municipal bond is calculated each year. This page contains a bond pricing calculator which tells you what a bond should trade at based upon the par value of the bond and current yields available in the market sometimes known as a yield to price calculator. With links to articles for more information.

Your annualized rate of return from the municipal bond or other investment at maturity taking into account all cash flows. Risk is a key factor when making bond investments. Calculator Guide A Beginners Guide to Investing in Bonds.

Clicking the Calculate button will return the GAR. The bond pays out 21 every six months so this means that the bond pays out 42 every year. Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bonds par value.

Input each years return rate. This calculator shows the current yield and yield to maturity on a bond. It sums the present value of the bonds future cash flows to provide price.

If you report savings bond interest to the IRS every year. You can also sometimes estimate the return rate with The Rule of 72. It returns a clean price and dirty price market price.

In general premiums must be. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. It all depends on your rate of return your time horizon taxes and a.

Understanding your return on investment ROI can help you achieve your goals. To use bond price equation you need to input the. Sovereign Gold Bond Return Calculator.

Current Yield vs Yield-to-Maturity YTM The yield-to-maturity YTM is the annualized return expected to be earned on a bond assuming that the bond is held until the date of maturity. After 5 years the bond could then be redeemed for the 100 face value. Click the Get Started Link above or the button at the bottom of this page to open the Calculator.

Input the number of years. This bond price calculator estimates the bonds expected selling price by considering its facepar value coupon rate and its compounding frequency and years until maturity. Future Value Compound Interest EMI Calculator.

SGS Bond Calculator This basic calculator illustrates the relationship between SGS bond prices and yields. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

How To Calculate The Rate Of Return On A Coupon Bond Youtube

Yield To Maturity Ytm Formula And Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

Bond Yield Calculator

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-02-10d2adc981ea475eb2165a5ec13082ed.jpg)

Current Yield Vs Yield To Maturity

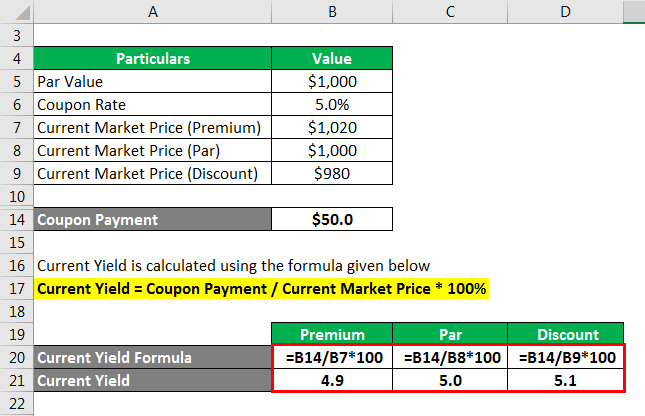

Current Yield Bond Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

Bond Yield Formula Calculator Example With Excel Template

Bond Yield Calculator

Bond Equivalent Yield Formula Calculator Excel Template

Bond Yield Formula Calculator Example With Excel Template

Zero Coupon Bond Formula And Calculator Excel Template

Bond Yield Calculator

Bond Yield Calculator

Microsoft Excel Bond Yield Calculations Tvmcalcs Com

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube